Year-end roundup 2019. 2019 Tax Espresso Special Edition 5 Extension of tax incentive for issuance of-i sukuk Ijarah and Wakalah.

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Honest Trusted Reliable Tax Services.

. 1 The types of breastfeeding equipment that are entitled to this income tax relief in Malaysia are the. Tax revenue remains a catch-up game for boosting govt coffers. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Legal News Analysis - Asia Pacific - Malaysia - Tax Malaysian Tax Reliefs And COVID-19. IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers. 22 October 2019.

Medical expenses on serious diseases including. Honest Trusted Reliable Tax Services. Take Avantage of Fresh Start Options Available.

Here are the income tax rates for personal income tax in Malaysia for YA 2019. Ad As Heard on CNN. Receiving further education in Malaysia in respect of an award of diploma or higher SOCSO RM250 18.

IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers. - BBB A Rating. Based on this amount the income tax to pay the government is RM1000 at a rate of 8.

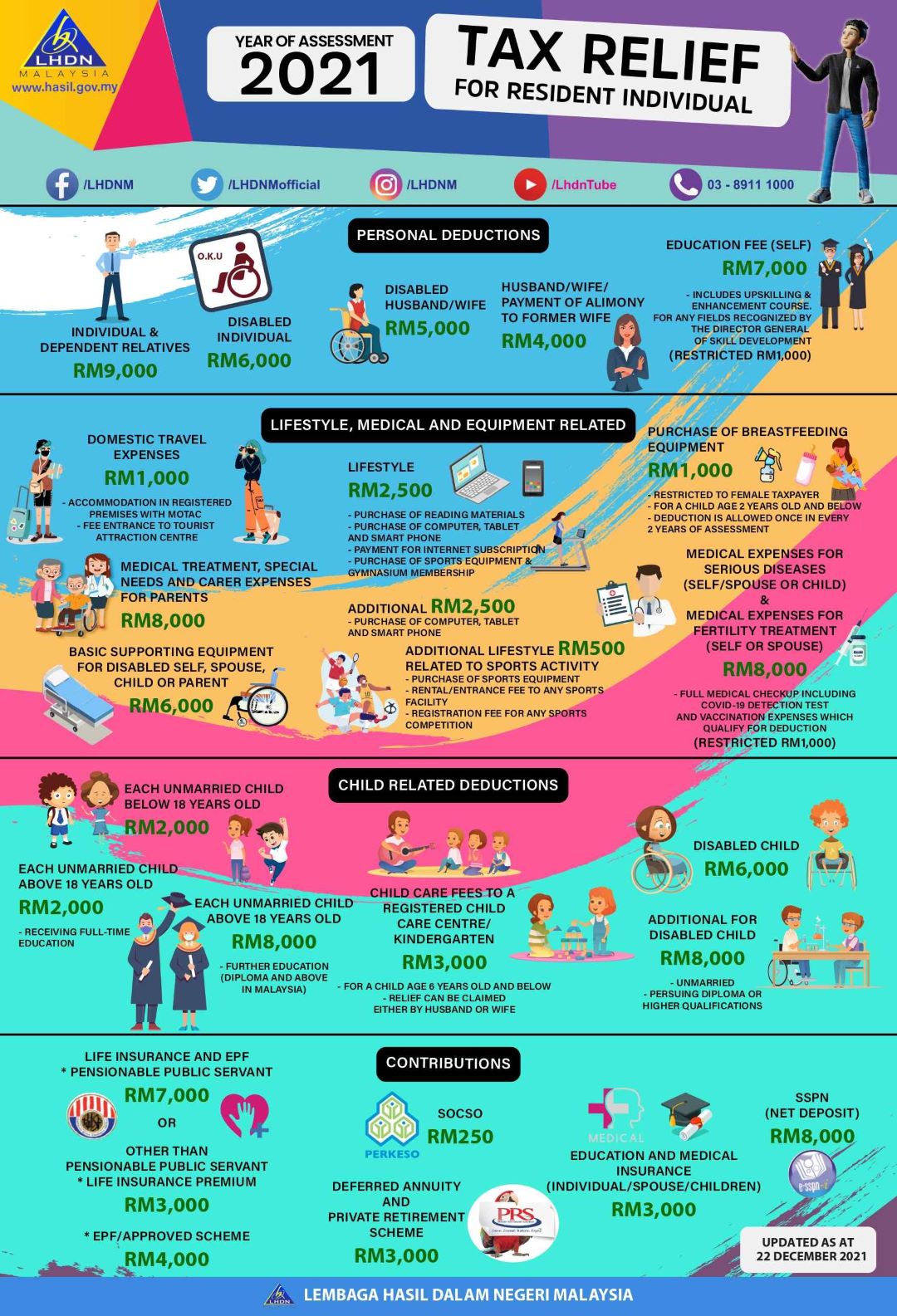

These are the types of personal reliefs you can claim for the Year of Assessment 2021. Actual tenancy takes place in the year of. For 2019 the government is estimated to collect RM1899 billion in taxes.

Here are some of the more common reliefs that you likely dont wanna miss out. One of them is. Tax Relief Year 2019.

With effect from 1 January 2019 this tax exemption will cease. This article will look at Malaysian tax relief efforts and. However if you claimed a total of RM11600 in tax relief your chargeable income would.

Affordable Reliable Services. Malaysias Minister of Finance presented the 2019 Budget proposals on 2 November 2018 offering some increase in personal tax reliefs and a reduction in contributions. There are actually two amounts you can claim for your parents.

20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying. There will be a two. Ad Settle Tax Debts up to 95 Less.

Skip to primary navigation. Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2. However if you claimed a total of RM11600 in tax relief your chargeable income would.

On 2 November 2018 Malaysia released its 2019 budget the Budget. The amount of tax relief year 2019 is determined according to governments graduated scale. Take Avantage of Fresh Start Options Available.

TAX RELIEF for resident individual i. Indonesian Tax Guide 2019-2020 3 Contents About Deloitte 4. PENSIONABLE PUBLIC SERVANT CATEGORY.

Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. Cost of basic supporting equipment for disabled individual self spouse child or parent RM6000. Ad As Heard on CNN.

Find out what are the list of items you can claim when you file for income tax relief in Malaysia. Solve Your IRS Tax Debt Problems. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher.

Heres a more detailed look at the fine print behind each income tax relief you can claim in 2020 for YA 2019. Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. Individual and dependent relatives.

The Inland Revenue Board Of Malaysia IRB has increased its assessment year 2019 resident individual tax relief for life insurance and Employees Provident Fund EPF. Solve Your IRS Tax Debt Problems. - BBB A Rating.

Granted automatically to an individual for. Ad Settle Tax Debts up to 95 Less. What are the tax reliefs available for Malaysian Resident Individuals in 2021.

This infographic will give you an overview of all the tax deductions and reliefs that you. Each unmarried child and under the age of 18 years old. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

Affordable Reliable Services. Pioneer losses refer to. Get maximum rebates and save more money with these tips.

Malaysia Residents Income Tax Tables in 2019. Receiving further education outside Malaysia in respect of an award of. Self and dependent relatives.

Effective for the year of assessment 2019. Other corporate tax proposals. Based on this amount the income tax to pay the government is RM1000 at a rate of 8.

Lhdn Irb Personal Income Tax Relief 2020

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Higher Tax Relief For Insurance And Epf In 2019 Assessment Irb The Edge Markets

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Malaysia Personal Income Tax Relief 2022

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Personal Income Tax Relief 2021

Income Tax Malaysia 2018 Mypf My

Personal Tax Relief Malaysia 2019 Madalynngwf

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

Lhdn Irb Personal Income Tax Relief 2020

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Here S How To Maximise Your Education Income Tax Relief